“National Pension Scheme” i.e. NPS is an initiative of the Central Government of India. Let’s understand NPS in detail, its features, and all about what is Tier 1 and Tier 2 in NPS through this blog. The idea of the introduction of NPS by the Central Government of India is to increase the retirement savings of the general public.

What is NPS?

NPS is one product that is meant for Retirement savings. It simultaneously offers investment in Equity over a long-term period.

Who can invest in NPS?

This scheme is open to everyone. Hence, any individual who is citizen of India in the age group of 18-70 years can start investing in NPS. Both resident and Non-resident is eligible, but subject to citizenship. An investor cannot be open an account in joint capacity.

The procedure of NPS Account Opening:

There are two ways to open the NPS account,

- Investors can visit the POP-SP (Point of Presence service provider). The said POP-SP could be a bank branch or post office.

- Investors can open an account online through the eNPS website using PAN and bank details.

What is Tier 1 and Tier 2 in NPS?

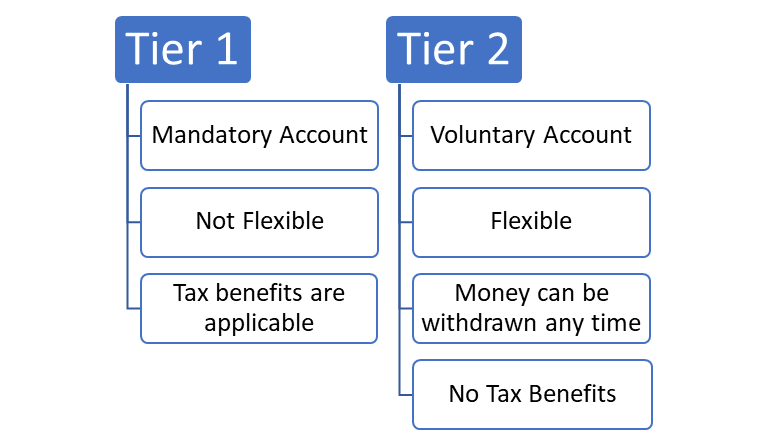

NPS offers you two types of accounts:

Tier I and Tier II.

Few benefits of having Tier II NPS Account:

- Cost effective: No additional annual maintenance Charge, No levy of exit load & No minimum balance required

- Good for Emergency: Withdrawal at any point of time

- Convenience: Transfer fund to pension account (Tier I) any time

- Preference: Separate Nomination facility available

- Flexibility: Option to select different Investment pattern from Tier I

Working of NPS:

Step No.1: Every investor gets a PRAN i.e. Permanent Retirement Account Number afterinvesting in NPS. As per the name it is unique number.

Step No. 2: An email alert and SMS alert are issued to the investor’s registered email address and mobile number following the creation of the PRAN number. These are distributed by the Central Record-Keeping Agency, or NSDL-CRA.

To create wealth for retirement and maintain standard life style, investors contribute in NPS frequently during their working span of life. When an investor retires or leaves the NPS, they can withdraw the entire capital. To guarantee a monthly pension after retirement, a certain percentage of the corpus must be invested in an annuity.

Who is going to manage my money in NPS?

Pension Funds manages money in NPS in accordance with the provisions of the PFRDA Act. Hence, the investors get the advantage of professional management of money.

The good news is Investors select the Pension Fund Manager (PFM) while registering for NPS. A variety of options are available for Pension Fund Manager (PFM).

A few examples of PFM are as under,

- HDFC Pension Management Company Limited

- ICICI Prudential Pension Funds Management Company Limited

- SBI Pension Funds Private Limited

Benefits of Investing in NPS:

- Investment is voluntary. An Investor can contribute at any point of time in a Financial Year.

- Initial Investment is minimum. Investors can start with an initial contribution (minimum of Rs. 500 for Tier I and a minimum of Rs. 1000 for Tier II) at the time of registration. So, it is affordable for many retail investors.

- Option to choose a mix of Debt and Equity Investment according to the risk profile and age. Hence, suitable for every investor.

- Long-term investment in Equity is possible, so, higher chances of accumulating wealth for retirement.

- Option to choose a Pension Fund for managing money.

- Additional deduction of Rs. 50,000/- over and above the 80C limit under the Income Tax Act. Hence, it is a tax efficient investment.

Active Investment Choice & Auto Investment Choice in NPS:

Under NPS, there are two options available with the investor i.e. Active Investment and the second one is Auto Investment.

Active Investment Choice:

As per the name, in active choice, an investor actively decides the amount to be invested in each Asset Class. Therefore, suitable for experienced investors.

Investors decide the Asset Class and also the percentage (%) allocation in each asset class. Pension Fund Manages invest money into four Asset Classes as Equity, Corporate debt, Government Bonds, and Alternative Investment Funds.

- Asset class E: Equity and related instruments

- Asset class C: Corporate debt and related instruments

- Asset class G: Government Bonds and related instruments

- Asset Class A: Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, etc.

Multiple Asset Classes can be selected as mentioned above. However, for the safety of investors, there are some restrictions due to the age of the investor.

Details are as under,

- Investors up to 50 years, can invest maximum of 75% of the total asset allocation in Equity asset class.

- From 51 years onwards, the maximum investment in Equity will be as per allocation matrix provided.

- In case of Alternative Investment Funds: The percentage (%) contribution value cannot exceed 5%.

- The total asset allocation across E, C, G, and, A asset classes must be equal to 100%

Auto Choice:

For beginners, Auto Choice can be the best. In Auto Choice, an investor’s money will be automatically invested in different asset classes as per the age of an investor.

As the investor’s age increases, the Equity & Corporate Debt exposure is going to decrease automatically. Accordingly, the exposure to Government Bonds and related instruments tends to increase.

There are three different options available under ‘Auto Choice’ in NPS. These are as per the risk-taking capacity of an investor.

- Aggressive Choice: The maximum Equity Investment is up to 75% of the total asset allocation.

- Moderate Choice: The maximum Equity Investment is up to 50% of the total asset allocation.

- Conservative Choice: The maximum Equity Investment is up to 25% of the total asset allocation.

Know more: FAQs on National Pension Scheme

How much returns can we expect from NPS?

Being an Equity investment, be it a small portion, returns can be higher than pure Debt investment such as PPF, KVP or NSC.

As per the past records, the NPS scheme has delivered 8%-12% annualized returns over a decade. However, it is not guaranteed. It is depending on Pension Fund Management and allocation towards Equity.

Let’s see some practical examples,

Assumptions:

| Monthly Investment | Rs. 5,000/- |

| Age | 30 Years |

| Total Investment Tenure | 30 Years (360 Monthly Payments) |

| Expected Returns | 9% p.a. |

| Pension/Annuity (%) | 40% (as per the rule) |

| Lump sum Amount (%) | 60% (as per the rule) |

| Expected Returns of Pension /Annuity | 6% p.a. |

Results:

| Total Investment Amount | Rs. 18,00,000/- |

| Pension Corpus Accumulated | Rs. 92,22,000/- |

| Lump sum Amount (60%) | Rs. 55,33,000/- |

| Pension/Annuity (40%) | Rs. 36,89,000/- |

| Monthly Pension | Rs. 18,400/- |

When investors can withdraw money from NPS?

Investors should continue this investment till 60 years of age. However, after completing at least 3 years of investment, 25% of money can be withdrawn for specific purposes such as,

- Children’s marriage,

- Higher studies,

- Purchasing a home,

- Medical treatment, etc.

The withdrawals can be 3 times (with a gap of 5 years) in the entire tenure of investment.

Know more: FAQs on National Pension Scheme

Conclusion:

NPS is a great investment instrument for saving money for the Retirement Period. Investors often ignore saving for retirement. However, this is dangerous.

Read Blog: Retirement: Peaceful Years or a Nightmare…Your Choice!

Due to few restrictions on the withdrawal of money, investors invest money for the long term. Accordingly, investors can accumulate wealth as the money is invested in the Equity Asset Class. Experts’ investors can go for the Active Choice option. On the other hand, new investors can stick to Auto Choice.

I hope you have found the features of NPS, its benefits, and all about what is Tier 1 and Tier 2 in NPS.