Have you ever experienced that your family’s monthly expenses are the same as it was ten years ago? Or is the price of your favorite dish being the same as it was five years ago? Nope! Right. It is due to inflation.

As a human tendency, we always see the negative side first. Now tell me, is your “Income” today at the same level as it was five years ago? Not at all. Your income increases, and similarly your expenses. But the important point here is which rate is higher? The rate of increase in income or the rate of increase in expenses?

In this blog, we’re going to take a journey into the world of inflation, understand what it is, and figure out if it’s a bad guy or a good buddy.

What Exactly Is Inflation?

Inflation is defined as an increase in the pricing of goods and services. Assume you have Rs 1,000/- in your pocket and wish to buy a pizza. If the price of a pizza is Rs 250/- today, you can buy four pizzas; but, if the price rises to Rs 300/-, you will no longer be able to buy four pizzas.

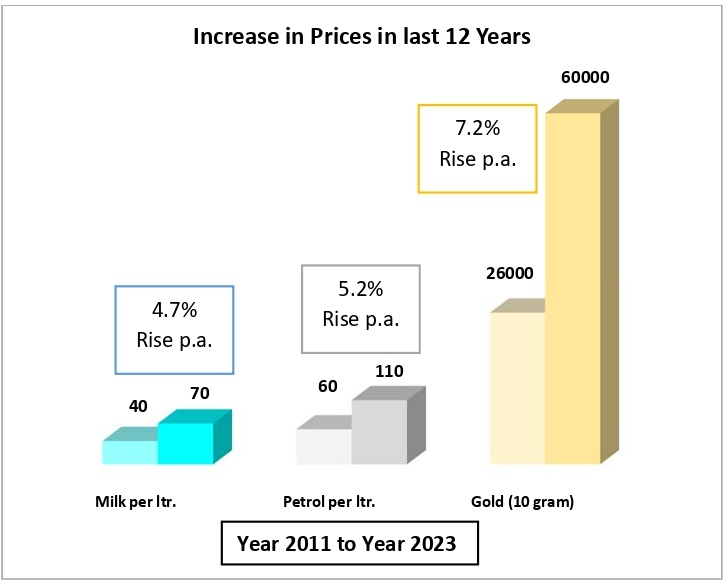

In 2011, you could buy 1.6-liter petrol with Rs 100. But for the same 100 rupees, you cannot buy even 1 liter of petrol today.

Simply put, it means that your money doesn’t buy as much as it used to.

Why Inflation Exists?

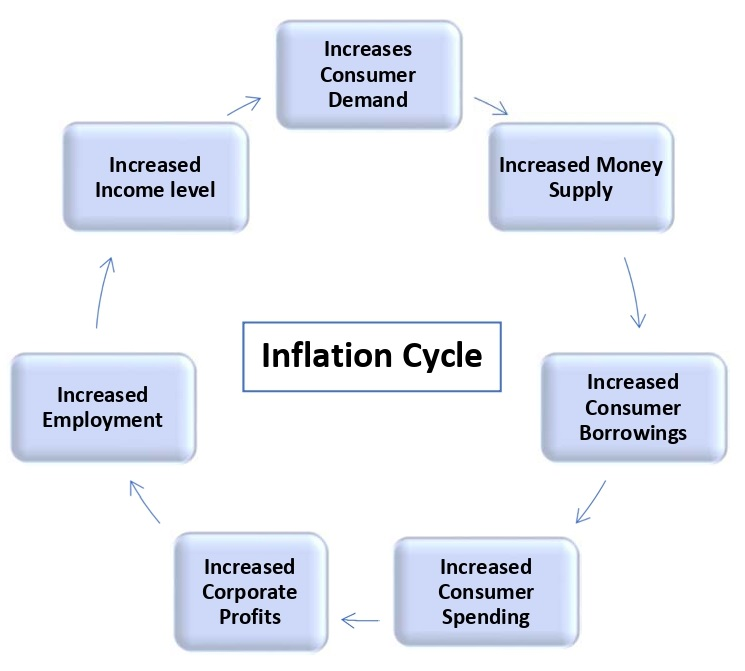

Put on our detective hats and investigate why it occurs. The very basic reason is that the economy grows with time. More people are employed, more companies are operating, making profits, and everyone wants a piece of the action. Price increases may result from increased demand for goods and services.

Imagine you have a big chocolate cake, and suddenly, more friends come to the party. Everyone wants a slice of that delicious cake. But if the cake stays the same size, you might have to cut smaller slices to make sure everyone gets some. Similarly, when more people want the same goods, like toys, cars, and food, but the supply doesn’t grow as fast, prices tend to go up.

Is Inflation a Bad Guy or a Good Buddy?

Now, here comes the important question: Is inflation a friend or a foe? Well, it’s a bit of both, like a mischievous friend. Let’s see why.

The Friendly Side of Inflation:

Believe it or not, a little bit of inflation can be a good thing. It can encourage people to spend their money instead of hoarding it. If you know that prices will go up a bit, you might be more likely to buy that new video game or that cute teddy bear today instead of waiting. This can keep the economy moving, like a merry-go-round.

The Enemy Side of Inflation

But too much of a good thing can turn bad. When inflation gets out of control, it can hurt people’s wallets. Imagine if the price of a pizza doubled in just a month! Suddenly, your pocket money wouldn’t buy you much cheesy goodness. Also, if prices rise too quickly, people might stop spending because they’re worried about what things will cost tomorrow. This can slow down the economy, and that’s not good for anyone.

Advantages:

- Promotes Spending and Investment: Mild inflation can motivate customers to spend and invest instead of saving. People are more willing to spend and invest when they expect prices to rise, which can boost economic activity.

- Reduces Real Debt: Over time, inflation can decrease the real worth of debt (Loan). Borrowers benefit from this because they repay loans with money that is less valuable than when they borrowed it.

- Adjustment Mechanism: Inflation can serve as an adjustment mechanism in the labor market. Wages and salaries might rise with it, helping workers maintain purchasing power.

- Promotes Wage Negotiations: Inflation can create an environment where wage negotiations become more active. This can lead to fairer compensation for workers.

Disadvantages:

- Diminishes Purchasing Power: Inflation diminishes money’s purchasing power. People can buy fewer goods and services for the same money when prices rise. If their income does not increase at a good pace, it leads to a decrease in their standard of living.

- Uncertainty: High inflation rates can have a devastating effect on the economy. Long-term investments and financial decisions may become more difficult for businesses and people to plan for the future.

- International Competitiveness: High inflation rates can reduce a country’s international competitiveness as its goods and services become more expensive relative to those of countries with lower inflation rates.

- Nominal vs. Real Confusion: Inflation can lead to confusion between nominal values (values expressed in the current Rupee) and real values (values adjusted for inflation). This can complicate economic analysis and decision-making. For example, you are earning interest @8% p.a. on your Fixed Deposits, but when you consider inflation @6% p.a., your real earnings come around only @2% p.a. over and above the inflation rate.

- Policy Challenges: RBI and the Government must carefully manage inflation to prevent it from going out of control. Excessive inflation can be difficult to control and can have severe economic and social consequences.

Balance is the Key!

The impact of inflation depends on its rate, duration, and how well the economy’s institutions and policies manage it.

Inflation might be a tricky character, but it’s not all bad. It’s like seasoning in your favorite dish – a little can make it taste amazing, but too much can spoil the whole thing. So, the key is finding the right balance. Economists and policymakers work hard to keep it at a healthy level – not too high & not too low. They want to ensure your pocket money can still get you the things you love without making them too expensive.

“Just remember, inflation is a friend when it behaves, but it can become a bit of a troublemaker if it gets out of hand.”

Very well written and beautifully explained in simple way as usual.