“Knowledge is having the right answer. But, Intelligence is about asking the right Questions”

– Anonymous.

Hence, it’s been said that Questioning is the beginning of Intelligence. Before you start investing, some important questions need to be answered. This will bring clarity to your decisions.

WHOM to ask the questions?

If you are not into Finance or new to the finance world, you should consult your Financial Consultant before you begin an investment journey. Experts will always have a helicopter view of your investments. He will have different angles such as Taxation, Safety, Liquidity, Inflation Adjusted Returns, Risk, etc.

However, you are the best judge in some cases. Few questions you need to ask yourself.

WHY you want to start investing?

The very first question you need to ask yourself is ‘Why’ you are investing; so that the purpose is attached to your Investment. Be it a child’s Education, Marriage, House Purchase, or any other goal, give name to your Investment.

For WHOM am I investing?

As a family person, we tend to invest on behalf of our family members, such as children, parents, brothers or sisters, etc.

Recognize the investment with purpose and the person. Don’t call it “This is an investment in HDFC Mutual Fund” instead call it “This is my child’s education or “This is my new Mobile” To be consistent, this habit will help.

WHEN do I require my money back?

Ask this question to yourself to understand the time frame of the Investment Goal. Don’t invest your money randomly. If to do so, you will be panicky and fearful when markets are down, and greedy and tempted to withdraw when markets are up.

HOW MUCH money should I invest?

Everyone asks this most popular question before investing. There are certain steps you need to follow to discover the right amount of investment. However, it is not necessary that you would be able to invest the same amount to achieve the goal.

The required amount of investment and actually investing that amount are two separate things. If you cannot invest the entire required amount, start small, but invest the money. Shortfalls may arise; however, you will not have to depend entirely on borrowings or withdraw your money.

WHAT is your Risk-Taking ability?

Risk-taking ability is how much risk you can take with your investment. This ability depends on your backup plan, if something goes wrong at the 11th hour.

For instance, you have been investing for the last 2 years towards the purchase of a car. At the time of need, if the market is down or you are unable to withdraw money due to any reason, will you be able to manage money without hampering your existing portfolio much?

If yes, then your risk-taking ability is higher, and vice versa. It is nothing but dependency.

Further, the willingness to take risks is completely different from than ability to take risks. Ability is more important than willingness as the ability is based on the scientific set of questions.

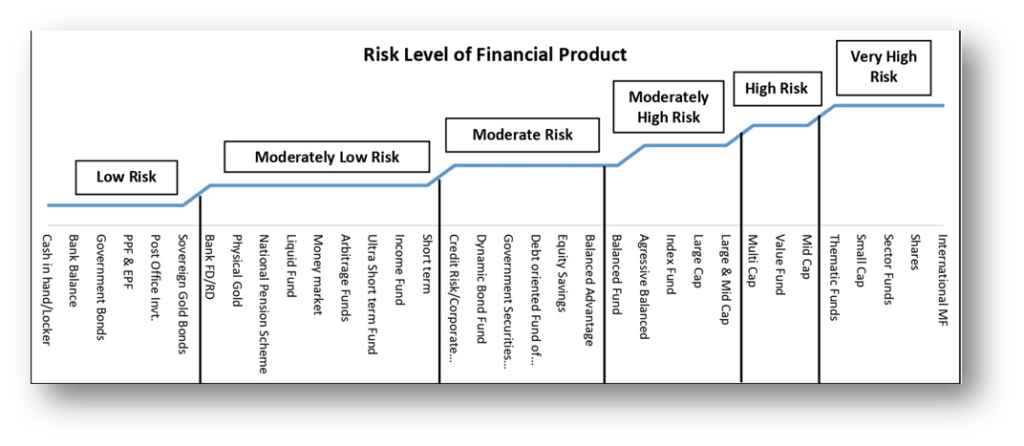

This ability is categorized as under,

- Low

- Moderately Low

- Moderately High

- High

- Very High

You can do your risk assessment from various popular websites such as Money Control.

WHICH Asset Class is suitable for my Investment?

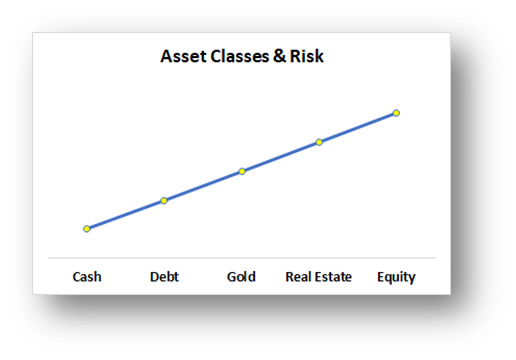

Now as you know your Risk-taking ability, accordingly you can choose mix of asset classes. Main Asset Classes to invest are Equity, Debt, Cash, Gold, Real Estate, etc.

The level of risk is calculated on the basis of price volatility and the potential to deliver negative returns.

You can choose your asset class accordingly or you can diversify your investment and create a mix of Equity & Debt.

WHERE should I invest my money?

After knowing your Risk-taking ability and choosing the right asset class, it’s time to choose an investment product. Based on your Risk-taking ability, you should choose investment products.

HOW should I review my Investments?

Investment is not a “Do It & Forget” exercise. It involves frequent reviews. Wrong investments should be redeemed or altered.

Especially with Equity Investment, Review becomes the most important aspect. Keeping an eye on the returns of the product, accumulated corpus, comparative analysis with other peers, market scenario, and residual tenure of financial goal, should be considered.

If you are not into Finance, please consult your Financial Advisor.

These are all the Key Questions to Ask Before You Begin Investing

Conclusion:

You will agree with me if you are a parent of a toddler or preschooler. They drive you crazy with questions. This is can little irritating at times. But believe me, this art of questioning is going to help you and them for the rest of your life.

Quick sum-up of Key Questions to Ask Before You Begin Investing.

Very nicely elaborated the importance of investment. Very convincing. 👍

I feel after reading this article.

If u want to learn something new.

U start analysis first.

Well explained analysis

For investment

Why,How,Whom and where.