In our last blog, we have seen the features of National Saving Certificate (NSC) and NSC excel calculator. Similarly, in this blog we are going to explore SCSS features & SCSS Calculator.

Read previous blog: Post Office NSC Calculator: Download Excel Format Now!

Download Now: NSC Excel Calculator

Now, in this blog let’s dive into the famous Post Office scheme i.e. “Senior Citizen Savings Scheme”. SCSS is one of the most popular investment options among senior citizens.

Download Now: SCSS Calculator in Excel

| Senior Citizen Saving Scheme (SCSS) offered by | Government of India |

| Investment through | Post Office |

| Who can open an account of SCSS? | 1. Senior Citizen (an individual above 60 years of age) 2. Retired Civilian Employees above 55 years of age and below 60 years of age. But, subject to condition that investment to be made within 1 month of receipt of retirement benefits. 3. Retired Defense Employees above 50 years of age and below 60 years of age. But, subject to condition that investment to be made within 1 month of receipt of retirement benefits. |

| Where to open an account? | 1. Post-office branch 2. Nationalize Banks 3. Few private banks |

| Documents required | 1. Recent passport size photograph 2. Identity Proof 3. Address Proof 4. Proof of age |

| Interest Rate | 8.20% p.a. (as declared for October 2023 to December 2023 quarter) |

| Change in Interest Rate | Quarterly |

| Compounding Frequency | Annual |

| Interest Payable | Quarterly interest payment. Interest shall be payable on 1st April, 1st July, 1st October and 1st January. |

| Total Tenure | 5 Years |

| Minimum Deposit | Rs. 1,000/- and in multiple of Rs. 1,000/- |

| Maximum Investment Limit | Rs. 30,00,000/- |

| Application for SCSS | 1. Account can be opened as individual capacity or jointly with spouse only. 2. The whole amount of deposit in a joint account shall be attributable to the first account holder only. |

Other Features of SCSS:

| Taxability | 1. Interest is taxable if total interest in all SCSS accounts exceeds Rs.50,000/- in a financial year 2. TDS at the prescribed rate shall be deducted from the total interest paid. 3. No TDS will be deducted, if form 15H is submitted and accrued interest is not above prescribed limit. |

| Premature Closure | Allowed any time after date of opening: 1. No interest is payable, if account closed before 1 year. Further, if any interest paid in account, is is recoverable from principle 2. An amount equal to 1.5 % is deductible from principal amount, if account closed after 1 year but before 2 years from the date of opening, 3. An amount equal to 1 % is deductible from principal amount, if account closed after 2 years but before 5 years from the date of opening. 4. Extended account can be closed after the expiry of one year from the date of extension of the account without any deduction. |

| Extension of account | 1. Account holder may extend the account for further period for 3 years from the date of maturity 2. Account can be extended within 1 year of maturity. 3. Extended account shall earn interest at the rate applicable on the date of maturity. |

For more information you can visit official website of Post Office: https://www.indiapost.gov.in/Financial/pages/content/post-office-saving-schemes.aspx

SCSS Calculation:

Interest on SCSS is payable quarterly. The calculation is as under:

Let’s see some practical SCSS Calculation:

| Deposit Amount | Quarterly Interest Amount | Annual Interest Amount |

| Rs. 10,00,000/- | Rs. 20,500/- | Rs. 82,000/- |

| Rs. 20,00,000/- | Rs. 41,000/- | Rs. 1,64,000/- |

| Rs. 30,00,000/- | Rs. 61,500/- | Rs. 2,46,000/- |

Interest Rate: 8.20% p.a.

Download Now: SCSS Calculator in Excel

You can download forms from official website: https://www.indiapost.gov.in/VAS/Pages/Form.aspx#SavingCertificates

What are the Pros of Investing in SCSS?

- The Indian Government offers this Senior Citizen Saving Scheme. Hence, this ensures the safety of your deposit (principle).

- Assured Interest rates in this scheme, though subject to changes.

- For the Oct-Dec.2023 quarter, guaranteed interest rate is 8.20% p.a. which is much better than that offered by most of the banks.

- Interest is payable quarterly; hence this frequent payment is useful for senior citizens to manage their cash flow.

What are the Cons of Investing in SCSS?

- The maximum deposit amount is only Rs. 30.00 Lakhs. Hence, the maximum quarterly interest payment is around Rs. 61,500/- per quarter.

- A monthly interest payment option is not available. Hence, can not consider the interest in monthly budget calculation.

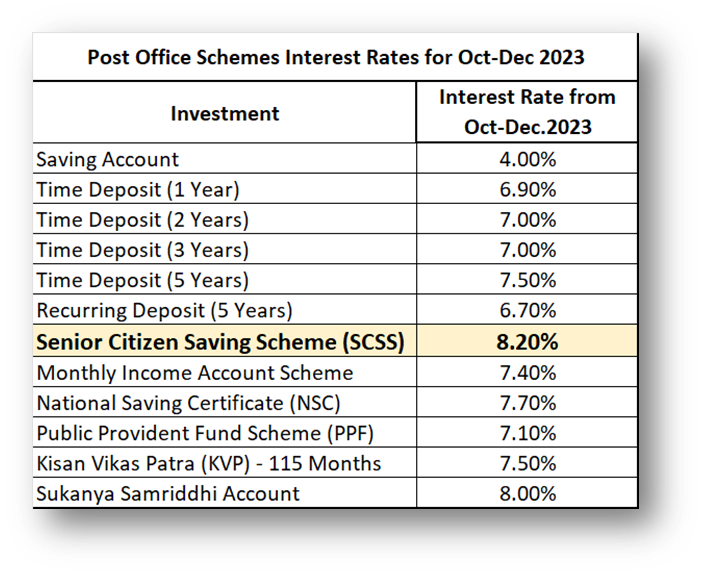

Interest Rates of Post Office Investments for October 2023 to December 2023 Quarter:

Conclusion:

Senior Citizen Saving Scheme (SCSS) is a popular investment due to its higher assured Returns and Government Guarantee.

Financial Advisors recommend that all senior Citizens must invest at least some of their money in this scheme.

Download Now: SCSS Calculator in Excel

Note: Calculation indicated in Excel is for information purpose only. Actual amount may slightly differ.

This information is really helpful to senior citizens. Very well explained the benefits of the scheme. Very nice.