For some reason, many people want to invest, but they fail. Remember we’ve all got that one stingy friend who is reluctant to throw a party, disappears from the bill counter, and always has several reasons why. One of the most common excuses is that “I don’t have any money. It’s month end. I had spent all of my money.” We make fun of him.

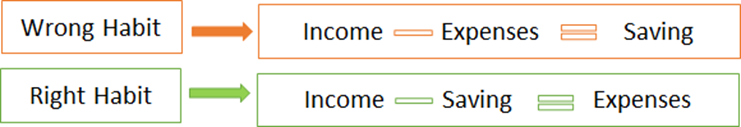

Jokes apart, but this is the situation of most people, which is not so pleasant. They want to invest but they don’t have money for it. Why does this happen? This happens because people do not prioritize investments. They intend to invest if at all they are left with money after spending.

Here are some tips to help you improve your investment habits. It is going to be a simple but effective way to enhance your investment strategy.

- Recording…Reviewing…Reducing!

This 3 “R” method will help you save and invest more. Your savings will automatically improve when you curtail unnecessary expenses. However, first of all, you must know how much you spend on lifestyle and entertainment. Then only you can reduce it. You can maintain a record manually or digitally. Your choice. Many apps in the market offer you this service.

One Master Rule of money outflow is “50/30/20” Rule. According to this, 50% of the money is to be spent on necessities, 30% on wants (entertainment, lifestyle, luxuries) and at least 20% should be saved. If your lifestyle expenses are more than 30%, you will have to cut them down.

- Make a Standing Instruction for investments just the next day of your salary and Automate your savings

Setting up a Standing Instruction the day after you receive your salary, is the smartest option. This allows for the automatic investment of a sum of money, making it easier to accumulate wealth.

By automating your savings, you can establish a solid foundation for financial growth. When your investment gets deducted immediately after you receive your salary, you calculate the rest of your income and manage your spending accordingly.

- Go on a Diet… “Financial Diet”

Diet is a fancy word. We need to make efforts to sustain it. We all do it to maintain health. But I am talking about maintaining financial health. Hence, dieting financially is important, wherein you curtail a few expenses intentionally.

Be it unused OTT subscriptions, shopping, dining out, or ordering food from outside, we spent a lot of money. Take a Money Saving Challenge and see how much you save and invest. Decide your time frame. After successful completion, reward yourself with a gift. This will create a sense of achievement and value for money.

On this note, I remind you of a famous Quote by Benjamin Franklin: “Beware of little expenses; a small leak will sink a great ship.”

- Shift your mind from “Expenses Goals” to “Saving Goals”

In general, we set goals like this. “I need to purchase this item in 2 years” or “I will purchase a new laptop from this Diwali Bonus” etc. Our most of goals are “Expenses centric”. Believe me “Enough” is a decision, not an amount. This needs to be changed a little bit.

I understand, that no one can curb spending beyond a certain limit to survive and maintain a standard of living. However, analyze and observe to set goals that are “Saving Centric”. For instance, if you are a spendthrift kind of person, start small. Set a goal like “I will save at least 10% of income per month for the next 6 months.” See the difference.

- Cooling time before you buy something, help you from overspending.

Some items instantly catch the eye and we tend to buy them. However, allowing yourself a cooling-off period before buying is one approach to prevent overspending. If you’re shopping online, put the item in your shopping cart and then walk away until you’ve had time to think about it. If it is essential, you will buy it. But, there are chances that you won’t buy that item as it was not required.

This trick will help you save money. And you can make the most of it by investing that money.

“Too many people spend money they haven’t earned to buy things they don’t want to impress people don’t like” – Will Rogers

- Shift from High-Interest Loans to Low-Interest Loans

At times, you avail of Consumer loans or Personal Loans to buy household items. You get loans instantly from private finance institutions, but you are charged a higher interest rate. They may go up to 30.00% p.a. in some cases. You end up paying higher EMIs. Instead, try to avoid availing of consumer loans as much as possible. As said earlier try to save for it, postpone your purchase if you can. Plan it and then buy it.

However, if you intend to avail of loans for any reason, avail to of banks that offer lower interest rates. The process may take 1-2 days of delay, but it is not heavy on your pocket.

Similarly, you can consider taking over your existing loans to banks that offer lower interest rates. Sometimes, you can save a lot of money every month, which you can invest effectively.

To sum up:

We should pay special attention to creating habits as in the future our habits will make us. So, make investing your habit. Saving is just a first step. Mindful investing is essential for financial well-being.