When it comes to entertainment, movies are the first that hits our minds. Apart from just entertaining, movies encourage us to take action. It initiates the thought process and gives us ideas and inspiration. Movies are a great medium to deliver messages. We learned the real meaning of life from ‘Zindagi Na Milegi Dobara’, the real meaning of success from ‘3 Idiots’, patriotism from ‘URI’, courage from ‘Manikarnika: The Queen of Jhansi’ etc. It is a never-ending list. In this blog, let me give you some examples of movies that have some hidden financial lessons.

Drishyam Series:

“Protecting the family is a primary duty of a responsible citizen. Don’t compromise your family’s dreams”.

No wonder, every one of you must have seen the Drishyam sequel by now. Being a responsible family man, the hero of the family Ajay Devgan wants to save his family no matter what.

In the movie, Ajay Devgan had to plan carefully to save his family, as they were stuck in an unplanned and unwanted situation. And the consequences of the same can be ‘imprisonment’.

But protecting a family financially is easy. And how can you protect your family financially? It’s simple.

By having adequate “Life Insurance (Term Plan)” and Health Insurance coving the total family, you can become responsible towards your family.

Thumb Rule: Have a Term plan which should be at least equivalent to 10 times your annual income. And for Health insurance, a minimum cover of Rs. 5 Lakhs or 50% of your annual income is required.

Financial Lesson: Make sure that your family will be able to maintain a standard of living even without you. Buy a Life & Health Insurance.

Must have qualities: Long term view, planning, and scenario analysis

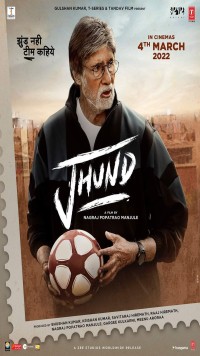

Jhund:

“No matter where you are today…you have the power to do wonders”.

No introduction is needed for this extraordinary movie.

Former sports coach Vijay Barse, the role played by Mr. Amitabh Bachchan invests time and hard-earned money to train underprivileged kids in football. He transformed their life. He infused the belief in underprivileged kids, that they can achieve something in life.

Now let’s see the financial perspective. It doesn’t matter, what is your financial background, your current net worth, or your current income, your small financial actions, and consistency will decide whether you will be financially free or not.

Don’t think that you have a very small amount to invest. Even if you start investing with a small amount of Rs 1000/-, it will get compounded and can create a good corpus in the future. Assuming 12% p.a. returns, your small monthly investment of Rs. 1000/- in Equity would become Rs. 5 lakhs after 15 years.

Financial Lesson: Equity Asset Class has the power to transform thousand into lakhs in years to come.

Must have qualities: Believe and patience

Uri: The Surgical Strike

“Failing to plan to planning to fail” (famous quote by Benjamin Franklin)

Major Vihaan Singh Shergill of the Indian Army, the role played by Vicky Kaushal, leads an underground operation against a group of activists who attacked a base in Uri, Kashmir, and killed many soldiers.

In the middle of a mission, Vihaan’s helicopter is forced not to cross the LOC due to unavoidable reasons. However, he and his team improvise the mission and change the decision by going on foot through a cave.

This classic movie teaches us how planning is important in any goal, be it financial or any other. Apart from planning to reach a goal managing and reducing the risk is equally important. Some unwanted circumstances happen, and you should be prepared for that.

In the financial context, planning and risk management covers the following,

- Keeping the emergency fund in liquid assets (at least 6 months of living expenses)

- Goal planning

- Proper asset allocation as per risk profile

- Timely review of investments and re-balancing of portfolio

Financial Lesson: Goal should be SMART – Specific, Measurable, Achievable, Relevant and Time-Bound

Must have qualities: Planning and Risk Management

Sultan:

“It’s never too late, age is just a number”

I would like to through some light on the second half of the film, Sultan. In the second half of the film, Salman Khan, a middle-aged wrestler, who gave up sports, now was looking for a comeback in the game. He defeated all the odds, learned from his mistakes, and chased his dream.

In my opinion, Sultan is a film that teaches us the power of hope, and determination and sets us free from our wrong thought processes related to age and time.

It’s never too late to start fresh. You may have made some financial mistakes in the past that caused you losses, however, stopping investments is not a solution for the same. Only learning from mistakes can help you reduce the guilt.

Buying the wrong insurance product, spending too much on luxuries, wrong asset allocation, and concentrated portfolio, all these mistakes can be improved.

At any age, you can start a suitable investment and improve your financial well-being.

Financial Lesson: Better late than never. Even if you are in your 40s or 50s, starting the investment journey and learning from your own mistakes are always appreciated.

Must have qualities: Determination and consistency

Phir Hera Pheri:

“Things are not as they seem”

Who can forget this masterpiece?

The trio of Raju, Shyam, and Babu Bhaiya, invests the money to double in just 21 days. After some time, they realize that it was all scam and they are bankrupt. Phir Hera Pheri is a comedy film that delivers a powerful message that ‘Greed’ is the enemy of every investor.

Many fraudsters take advantage of this greed, making investors invest their money in Ponzi schemes.

The main feature of these fraudulent schemes is the guarantee of very higher returns with little or no risk. Please remember that every investment has its own risk and return mechanism. Get the help of a Financial Advisor for investment.

Financial Lesson: Do your research and do not trust anyone blindly.

Must have qualities: Realistic approach

83

“Unity in Diversity”

Many Investment advisors and financial experts give an example of Cricket to explain the concepts of Investment and portfolio. Ans it is true. Cricket and Investment are closely related.

Have you seen all 11 players in a cricket team are bowlers or batsmen? No. A good cricket team consists of bowlers, batsmen, and fielders. Few are good at wicketkeeping and few are spinners. This diversification is important to build a strong team.

Similarly, exposure to different asset classes as per need is important.

There are 4 asset classes i.e. Equity, Debt, Cash, and Commodity.

Every asset class is important as it has different characteristics and proper Asset Allocation is important.

- Equity for long-term wealth creation and inflation-adjusted returns.

- Debt for the safety and stability of portfolio.

- Cash for emergency purposes.

- Gold to hedge your portfolio against inflation.

Financial Lesson: To win, your Investment Portfolio should be like a ‘Team’, where every asset class is important and should complement each other.

Must have qualities: Diversification

Super 30:

“The mediocre teacher tells. The good teacher explains. The superior teacher demonstrates. The great teacher inspires.” (famous quote by William Arthur Ward)

Anand Kumar, a Mathematics genius, the role played by Hrithik Roshan, who started an IIT training program for underprivileged students who can’t afford education. He is on a mission to prove that even the poor man can create some of the world’s most genius minds. He develops confidence among poor students that they can achieve something in life.

Just like him, a guide, Guru, or Professional is very important in the journey toward Financial Freedom. Everyone is not familiar with overall finance and investments.

Many of you invest through direct Mutual Funds just to save the fees of a Financial Planner or to save on brokerage. But, please understand that Investment or Financial Planning is not a one-time activity. Review & re-balancing is an integral parts of investment. Hence, the role of an Investment Advisor or consultant is required.

Financial Lesson: Professional guidance in Investment is very important.

Must have qualities: Experience, Knowledge, and expertise

To sum up:

Movies are not real. But there are a lot of real financial lessons that can be learned from movies. So, don’t limit yourself to entertainment. Learning never stops.

Hope you liked this blog. Share this blog with your friends.

Comment down below your favorite movie and the lesson from it.

Nicely explained.