Have you seen that Cadbury 5-Star Advertisement wherein that old lady says to a young boy “Thank you beta…achha hua tuney kuch nahi kiya”. The ad delivers a message that “Kabhi kuch na karke bhi dekho”. At times this logic also applies when it comes to Compound interest in investment.

You choose a queue at the billing counter of a Shopping Mall wisely. But you wonder, “Why does the other’s queue always move faster?”

This is because we believe that some actions should be taken to achieve the desired results. We take ‘Actions’ and believe that it will make things happen. Yes, it is correct. Making efforts, and taking action is very necessary. No doubt about it. But it does not ensure positive results. Sometimes what is required is ‘Patience’. All things are not in our control.

In this blog, I am going to throw some light on how you can make money by “not doing anything”. Doing nothing in the financial markets is the most difficult thing to do.

What is the 8th Wonder of the World?

According to Albert Einstein, the 8th wonder of the world is “Compounding”.

By definition, ‘Compound Interest’ means earning interest on interest. Most of you must have heard about this. However, a person cannot understand the secret of compounding just by reading the sentence. It does not lie in the percentage (%) returns you earn, but the power lies in “Time”. And to stay invested in a right investment product needs Patience.

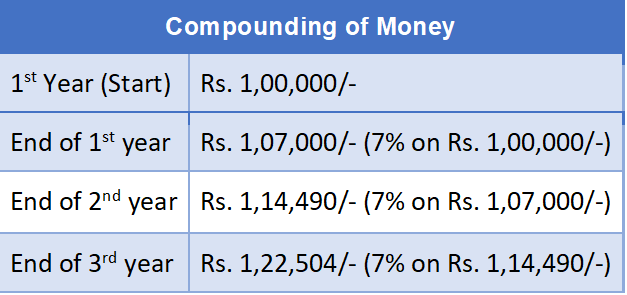

Actual calculation of Compound Interest:

You have a Fixed Deposit of Rs. 1,00,000/- is a bank @ 7% interest p.a.

And so on……

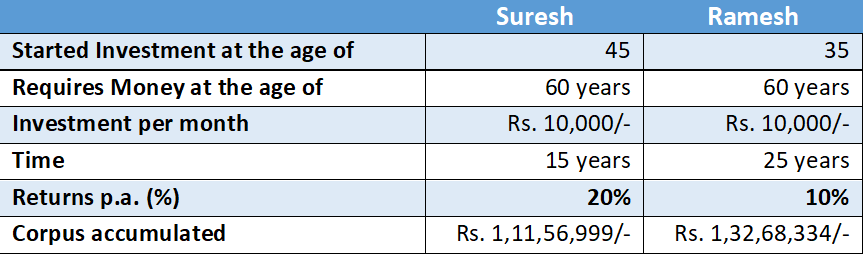

Let’s see another example of two friends Suresh & Ramesh. Both are saving money for their retirement.

Suresh has earned double returns (%) than Ramesh, however, just because Ramesh has stayed invested for a longer period, he could accumulate a larger corpus at retirement.

Those of you think that I don’t know about the Equity Market or Top performing Mutual funds, hence, I cannot create a great corpus. That is a myth.

As you can see from the above example, Ramesh could not choose the best-performing Mutual Fund scheme, and he earned average returns on his portfolio. Despite that, he could accumulate a higher corpus than Suresh as Ramesh let his money grow (Compound) for a longer period. Compounding works well with time.

I am not saying that don’t choose the best scheme. But don’t waste too much time finding the best Mutual Fund to invest in. The initial years of your working life are golden periods. Start early. Review and shift your investments frequently. But, not knowing which is the best scheme, is the wrong reason not to start investing.

Compounding in Investment is like a Snowball Effect.

In simple language, it is something very small at the beginning but becomes larger with time, and also perhaps can be dangerous and disastrous, though it might be beneficial instead.

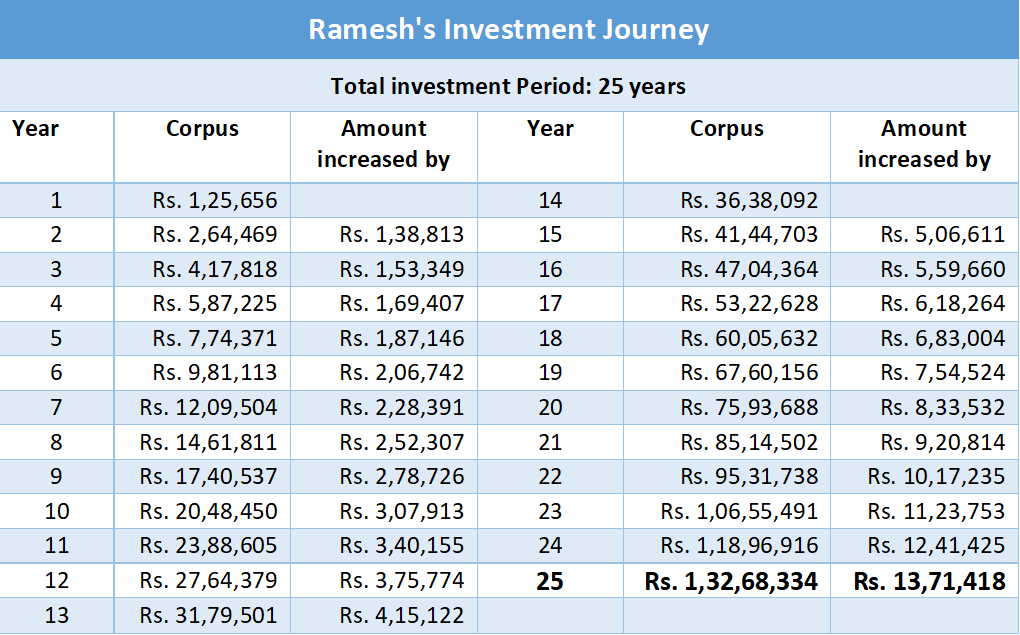

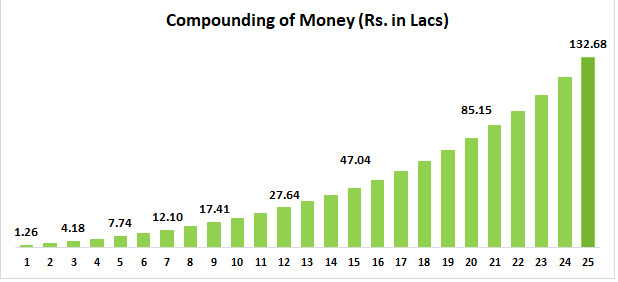

Let’s see how Ramesh has accumulated Rs. 1.32 Cr. in 25 years.

You can observe from the above table that, in the initial first 5 years, the growth of money is not that speedy. Now, take a glance at the last five years. Money has grown by more than Rs. 10 Lacs in the last 4 years. However, investment per year was just Rs. 1.20 Lacs (Rs. 10,000/-*12). This proves that Compounding actually shows the magic at a later stage of investing.

Graphical presentation of Compounding:

Key takeaways for Retail Investors:

- At times ‘Quality’ takes a front seat over knowledge

The qualities that will lead you to wealth is Patience. Compounding always rewards patience and consistency. It allows your money to work tirelessly on your behalf, like a loyal, invisible friend on your journey to financial success. Even if you don’t have technical knowledge about the financial market, still you can achieve financial success if you understand how the compounding of money works.

If you don’t have time to research or technical knowledge, most Financial Planners or Advisors recommend starting investment with NIFTY50 or SENSEX (Index Funds) which has India’s large top companies. As reported, NIFTY 50 has delivered more than 11% p.a. in the last 25 years.

- Never underestimate of power of a “Compounding”

It is like planting a tiny seed that grows into a towering oak tree. You invest a sum of money, and it earns you a return. That return, in turn, starts generating its own returns, and this cycle repeats itself, gathering momentum with each passing year. Compounding can turn even modest investments into substantial wealth.

- Taking advantage of Compounding doesn’t mean you should neglect the review of investment

It is important to give time to your money to grow. However, it is equally important to review your investments frequently. You need to make the necessary changes in the portfolio to get the maximum benefits. Sometimes, withdrawing and shifting money also matters.

Just make sure that you are not making impulse investment decisions due to greed and fear.

- Higher Time-Frame of Investment reduces the probability of Capital Loss

The higher your investment time is, the probability that you will incur losses will also reduce. The economy goes through the four stages i.e. expansion, peak, contraction, and recovery. Hence, if you stay invested for a longer period of time, your portfolio will through all these stages and there is less chance of capital erosion.

- Frequent Buying & Selling may hamper your investment returns

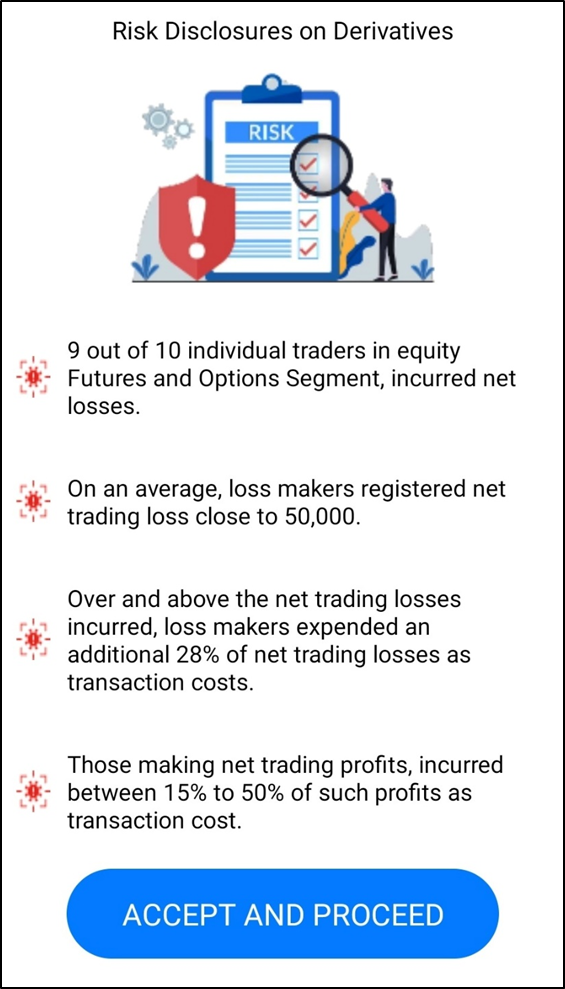

Many small investors for the sake of higher returns, frequently transact. Except for professional traders or experts, retail investors are not recommended to do so. It is just going to increase your transaction costs and hamper your returns. Furthermore, some investors get attracted to risky trading strategies such as ‘Futures and Options’ without proper practice and technical knowledge.

The below warning popped up when I logged into my D-mat account.

So, for small investors, it is better to transact only if it is required.

Summary:

“Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.” ― Albert Einstein.

Do not delay your investment. Time is precious.