It’s been said that “Health is Wealth”. Well…its true. However, we generally consider health as physical health. Apart from that, ‘Financial Health’ also matters in our life. That should be taken care of to maintain & sustain a good standard of living.

The exercise of Financial Health Check-up is similar to going for a Blood Test which we do periodically. Just like blood test measures the sufficiency and deficiency of minerals, vitamins, level of sugar, hemoglobin, etc.; financial health is measured through some ‘Ratios’. Simplistically, Ratios are relations between two or more figures.

Don’t worry, though this blog is about a few calculations, I will keep it very simple so that you will understand even without any technical knowledge.

Let’s explore some important ratios to assess our Financial Health in a very simple language.

Your Financial Worth (Net Worth):

Before understanding Net Worth, let me explain to you the meaning of the ‘Net’ word. Any Net figure arrives after deducting a particular item. Just like after deducting PF, Tax from Gross Salary, you arrive at your Net Salary. And here, Worth can be considered as Value.

Your Net Worth is nothing but the difference between what you own and what you owe.

If this difference is positive, congratulations, you are ahead of most of the people. It means your assets and investments are more than your liabilities i.e. loans.

Assets & investments includes property, shops, Plots, investment in Mutual Funds, Bank Fixed Deposits, Recurring deposits, PPF, EPF, NPS, Post-Office Investments, Shares, Gold, Bonds, debentures etc.

For instance, if your assets and investment are worth Rs. 10.00 Lacs and you owe Rs. 5.00 Lacs to the bank or any other person, your net worth would be Rs. 5.00 Lacs.

A Net Worth of Rs. 10.00 Lacs is better than a Net Worth of Rs. 5.00 Lacs.

According to experts, to arrive at a conclusion about whether your Net Worth is satisfactory or not, follow the below steps

- Step no. 1 – Multiply your age with your Gross Annual Income

- Step no. 2 – Divide the number by 10.

In case your net worth is equal to or more than the number you arrived at, then you can be called wealthy.

For example, if you are 40 years old and your gross income is Rs 15.00 Lacs, then your net worth should be at least Rs 60 Lacs to be called wealthy.

Mr. Thomas J. Stanley and William D Danko had used this Net Worth Formula in his book called ‘The Next-Door Millionaire’.

Surplus Ratio:

As the name suggests, Surplus means ‘Extra’. Here two components of the ratios are Income and Expenses.

The surplus can be monthly or annually. If the surplus is positive, it means your income is higher than your expenses.

Some people may wonder why income is always higher. Then why calculate this ratio? However, in some cases, your expenses can be higher than what you earn. Sometimes we fail to understand it. It is due to higher usage of credit cards, loans, withdrawal of existing investments, borrowings from family, etc.

After calculating the surplus, now we have to calculate the Surplus Ratio:

Surplus Ratio:

For example, your monthly surplus would be Rs. 40,000/- if your net income is Rs. 1,00,000/- and your expenses are Rs. 60,000/-.

That means your current surplus ratio is 40% (Rs. 40,000 / Rs. 1,00,000) which is good.

A surplus Ratio of 25% and above is considered a good ratio.

Savings to Surplus Ratio:

In the surplus ratio, we understood what is our surplus. With this ratio, we are going to see “What are we doing with this surplus?” Having a good surplus and using it effectively are two different things. Hence, this ratio is important that indicates whether we are saving and investing the balance amount.

Let’s continue with the earlier example. Your surplus ratio is good i.e. 40% amounting to Rs. 40,000/. However, if you are able to save/invest only Rs. 20,000/-, your Savings to Surplus ratio is 50% (Rs. 20,000 / Rs. 40,000). This indicates, that you actually don’t know where the rest of Rs. 20,000/- is going and you are calculating your surplus wrongly.

Ideally, your Savings to Surplus Ratio should be 100% i.e. you are expected to save the entire amount. However, theory and practice differ. So, at least it should be greater than 80%.

Debt to Income Ratio:

In this ratio, debt means the monthly loan burden on you for the loans that you have borrowed from banks. Accordingly, This ratio requires your total loan EMI burden and your net income.

The ideal situation would be that this ratio is 0% i.e. you don’t have any loan. However, this is not practically possible in every case.

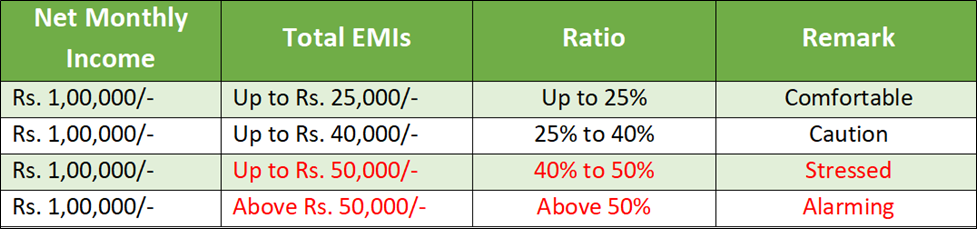

Different Scenarios of Debt to Income Ratio:

The higher the EMIs amount, the higher would be the ratio. Keep your borrowings on the lower side to improve your investible surplus.

Liquidity Ratio:

As we all know, most of the human body is water i.e. around 60%. Similarly, ‘Liquidity’ is the most crucial aspect of Investment Portfolio. The proportion of liquid assets needs to be around 60%.

An Asset called liquid if it can be easily and quickly sold, withdrawn, and converted into cash. Examples of liquid assets are cash, bank balance, Mutual Fund Units, Stocks, Bank FDs, etc.

On the contrary, Real Estate, Tax-Saving Investments, National Pension scheme (NPS), PF, etc. (which cannot be easily withdrawn) are illiquid assets.

That means if your total assets are worth Rs. 1 Crore, your liquid assets need to be around Rs. 60 Lacs.

To conclude:

Evaluate your Income, Expenses, Assets, and Liabilities. Calculate your Financial Ratios now to assess your Financial Health.