We plan for every financial goal, be it Child’s Education, Child’s marriage, House Renovation, or Travelling. However, we forget to plan for our Retirement. Today, I want to through some light on the mindset about ‘Retirement Planning’.

WHY is it important to plan for Retirement?

Let me ask you few questions…

Now, imagine the following different situations……

No.1: You are 28 years old, just started earning two years back. You are in need of a Laptop. Will you get a loan from Bank?

YES! May be an interest rate could be high…but definitely yes.

No.2: You are 35 years old, and having a business. You want to buy a new car. Will you get a loan from Bank?

YES!

No.3: You are 45 years old, businessman. You want to expand your business and want money for that. Will you get a loan from Bank?

YES!

No.4: You are 50 years old, a Chartered Accountant by profession. You want money for your child’s higher education. Will you get a loan from Bank?

YES! May be for a shorter duration…but definitely yes.

Let’s see the last one…

No.5: You are retired and you want money for spending your retirement time. Will you get a loan from Bank?

No!

Why? Because one of the things was common in all the above situations and that is ‘Earning Potential”. You were working in all the above situations, whether salary or business income. You had a repayment capacity.

As soon as you stop earning, you will have no option rather than utilizing your savings.

I strongly believe that borrowing is the last door and I am not at all encouraging you to borrow. Everyone should avoid it as much as possible.

But, here I want you to understand that when you are retired or not earning, this last door is closed for you as well.

You can get a bank loan (last ray of hope) for any of your financial goals, however, after your retirement, even this last source will not going to come for rescue.

I hope now you understand how much important is to save for your Retirement.

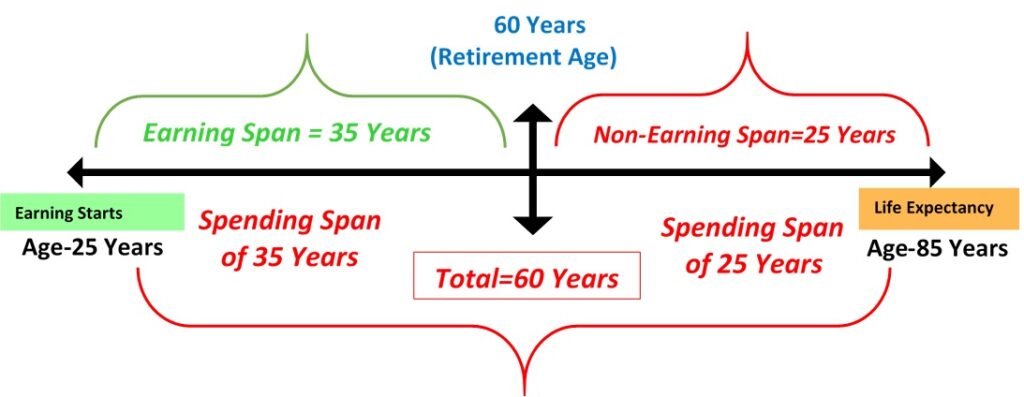

Whatever you are going to earn in your working span, let’s say 30-35 years. You need to grow it in such a way that the corpus will last you not only in your working span but also in your retirement period till your lifetime.

Your earnings for 35 years should be enough to cater your family needs for total 60 years as you can see from the above image.

Hence, only saving money is not enough, you need to grow your money smartly.

Till now, we have figured out the answer of WHY? Now, let’s jump in to HOW?

The first thing you should do is to start investing, no matter what your age is. Better late than never. To start, you can choose any asset class in which you are comfortable. But, the “Equity” asset class and “Mutual Funds” route is the most convenient, flexible, and easy to understand. Because Equity Asset Class can beat inflation in the long run. If you are a beginner and want to explore Equity, you can start investing in “Index Mutual Funds” or “Large-Cap” Funds.

Initially, what matters the most is the habit of investing, consistency is investment and not the returns. But, most people focus only on returns. Hence, they get attracted to 5 start funds or top-performing funds.

However, Returns matter, and your accumulated corpus depends mainly on how many years you have stayed invested. “Time” you spend in the market matters the most. And it is the only thing you have control over.

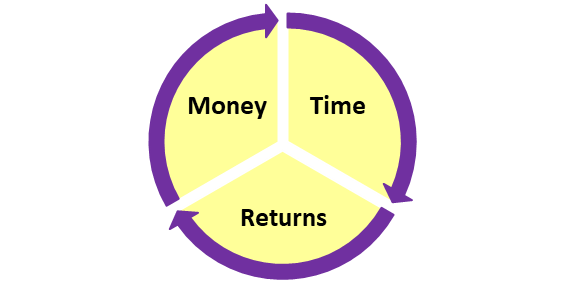

There are 3 things that decides your accumulated corpus of investment.

Out of there 3, investment amount depends on various factors such as no. of dependents, your income, expenses etc. Returns are not in your control. It is depending on the market globally. But, if you are in your 20’s or 30’s, you can start immediately and you will definitely have longer investment time.

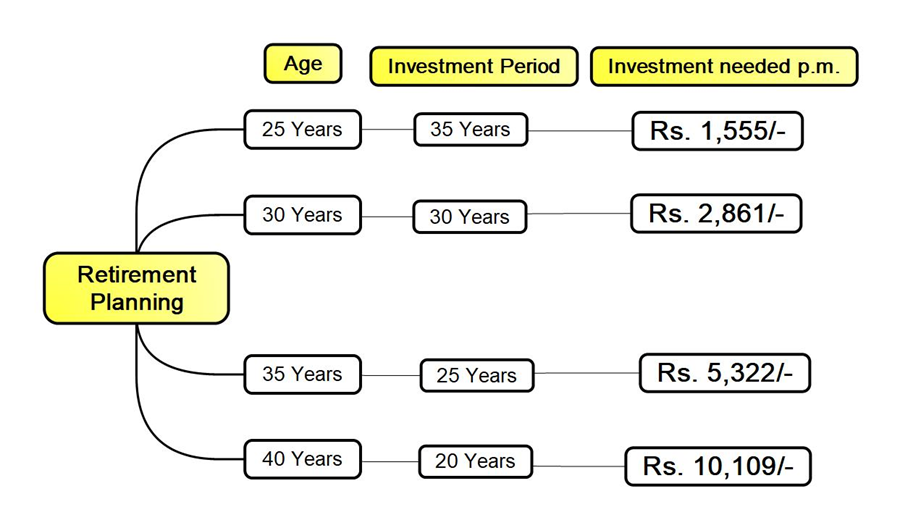

Let’s see one example. You want to accumulate Rs. 1 Cr. at the age of 60. The early you start, lower investment amount you will need. (Returns assumed: 12% p.a.)

As you can see, delay of just 5 years, can almost double up your required investment p.m.

Further, as I said earlier, returns are not the only thing. Discipline and consistency in investment matters.

| Scenario No.1 | Scenario No.1 | |

| Investment Period | 10 Years (120 Months) | 15 Years (180 Months) |

| Monthly Investment | Rs. 10,000/- | Rs. 10,000/- |

| Returns assumed | 18% p.a. | 12% p.a. |

| Corpus Accumulated | Rs. 33.00 Lacs | Rs. 50.00 Lacs |

See, even if you earn little lesser returns in scenario no.1, you would be accumulating a higher corpus. And at times amount matters as well.

So, start with Equity Mutual Funds or Index Funds. NIFTY 50 has delivered more than 11% p.a. returns to date since its inception (1996). Returns @11% p.a. seems lower. But, for longer periods, even lower rates can do wonders.

Just with Rs. 5,000/- SIP @11% p.a. for 25 years, you will manage to accumulate Rs. 79.00 Lacs. approx. which is not a small amount.

Research before the investment is a good habit. But, don’t waste too much time finding out the “One Best Fund” of all time to invest. Trust me, the best fund concept does not exist, as it changes with time. No fund will always give you the highest returns. Performance keeps changing. And the fund that provides the highest returns, does not necessarily be the best always.

Don’t get too scared or don’t take things too lightly. Extremes will not work in your favor.

Just be balanced and get going.

Start investing and I wish you all a peaceful Retirement!

Nicely explained.

Very well explained.

Nicely explained as we as home makers fail to think about retirement investments